Interested in launching a tokenization project in Austria?

Talk to us!

Tokenization in Austria

Austria is located in the heart of Europe. It is a land of stunning Alpine landscapes, rich cultural heritage, and historical significance. Its capital, Vienna, is not only renowned for its classical music, elegant architecture, and coffeehouse culture but is also known as a vibrant and innovative European hub for businesses. Austria’s commitment to environmental sustainability, high standard of living, and efficient public services make it an attractive destination for residents and visitors alike.

Austria’s strategic location, stable economy, skilled workforce and clear EU legislation towards cryptocurrencies make it an excellent choice for Web 3 businesses. With strong purchasing power and access to the broader EU market, Austria offers unique opportunities for growth and expansion 🚀

Why tokenizing in Austria?

Market Readiness

MiCA Regulation

As an EU member state, Austria is ready to implement and enforce the Markets in Crypto Asset (MiCA) regulation. Once effective, Web 3 ventures can operate throughout the EU if they secure licensing in any single member nation.

Convenient Location

Austria’s strategic position in the center of Europe connects businesses to a broader customer base, facilitating trade and expansion, and opening access to the European and global markets.

Stability

High purchasing power

Qualified Specialists and Talents

Austria offers a highly qualified and motivated workforce, making it an appealing business and research location. Talented specialists contribute to the success of Web 3 projects.

Location for Research and Innovation

Quality of Life

1. MyPower

Type: Tokenization of renewable energy

MyPower’s aim was to enable resilient, low-cost and energy efficient energy markets with the use of tokenization.

The project was supported by Riddle&Code in Vienna, when they realized that the global technology revolution and the shift to renewables derived from various decentralized sources. With MyPower, Riddle and Code, together with Wien Energie have envisioned to move the power balance from centralized electricity providers directly to millions of active consumers.

This introduced various challenges such as developing solutions for real-time invoicing, ensuring a stable energy supply and adapting to user’s needs and behavior.

The process starts when a user gets connected to a PV plant through a Trusted Gateway. Customers then can buy micro-shares of PV plants (with fiat money). In return, customers receive tokens for the amount of energy equivalent to their shares. The received tokens can be shared, traded or converted into other utilities. To manage the tokens and co-sign transactions, customers need to install a mobile app that serves as a wallet. The wallet is backed and secured by Riddle and Code’s proprietary key management service in the cloud.

Customers can redeem their tokens and use them to pay electricity bills or buy groceries at a supermarket, which contributes significantly to user friendliness.

Through this approach MyPower enabled automated transactions, removed middlemen and improved speed of transacting from 5-90 days to almost real-time settlement. We have also covered MyPower use case and its tokenization of wind turbines and solar energy in our recent article about the tokenization in energy industry.

Source: Whitepaper, Website

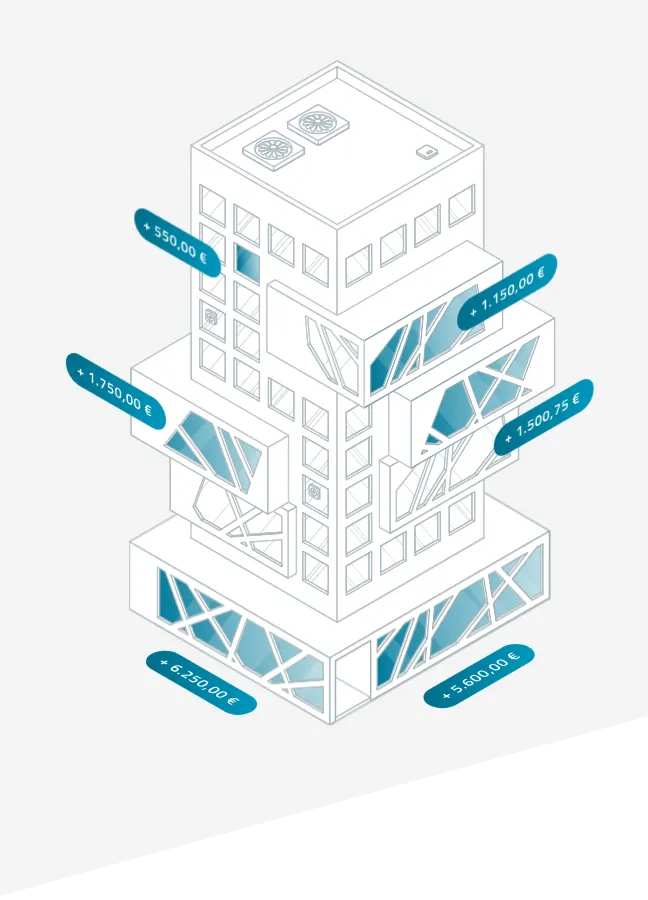

2. Rocksolid Estate AG

Type: Tokenization of real estate

The clear benefit for users is an investment into tokenized real estate with monthly payouts and a reduced risk because of diversified commercial real estate in Austria an Germany. According to Rocksolid Estate, rental yields currently range from 4-5% per year. As Rocksolid Estate grows, the user’s annual rental income increases. Users also gain exposure to the underlying property price appreciation, averaging 5-10% annually. The ROC token in this regard captures both the rental yield as well as the underlying property prices.

Important to note is that there is a possibility that the expected return may not be achieved, and the invested capital may be lost, up to a total loss according to the FAQs. The risk factors can vary depending on the asset, market dynamics, or other factors in the real-estate industry.

The legal structure enables token holders to participate in various company decisions. These participation rights are allocated to investors based on the number of acquired participation-right certificates and are detailed in the capital market prospectus.

Source: Website

3. The Kiss by Gustav Klimt

Type: Tokenization of art

The Austrian Gallery Belvedere, a UNESCO World Heritage Site is home to the world’s largest Gustav Klimt painting collection. An iconic painting named “The Kiss” has been tokenized and the NFT drop was successful on the Valentine’s day in 2022.

Each NFT (ERC721) on Ethereum represents a specific portion of the high-resolution digital “Kiss” and comes with a certificate to prove its authenticity.

The tokenized “Kiss” was available for purchase as a 1 out of 10,000 NFTs at a unit price of 1,850€ using ETH or a credit card, Paypal, or wire transfer. The NFT drop was valued at €18.5m.

However, the museum has sold initially a total of 2,600 NFTs. 220 NFTs have been traded on the secondary market ever since. Royalties were set at 10%, meaning that the Museum makes 10% of each secondary market purchase using Opensea or other platforms. The total revenue amount for the Museum accounted for €4,5m. While it’s an interesting use case of tokenizing paintings, the volume, price and unique users have not shown impressive numbers, making the fractionalized painting close to illiquid. The floor price is set around 0.33 eth while the maximum current offer sits at 0.11 eth (~200€ with included royalties)

In addition to purchasing the NFT, buyers were able to register as owners of their piece on the platform “thekiss.art” as well, where the picture can be viewed in its entirety.The legal part was taken care of by CMS legal experts, while the technical part of the tokenization was taken care of by Arteq. Unzer was a partner in payment processing.

4. The Natural Gem

Type: Tokenization of collectibles

The Natural Gem tokenized its €5 million Royal Portfolio on the eCredits blockchain and introduced the Habsburg Gemstone Token. The project came in partnership with Habsburg Fine Arts, eCredits blockchain and SimplyTokenized. The token is backed by authentic, untreated, color gemstones.

The Natural Gem is a Central European market leader in the international gemstone trade, deals exclusively with naturally colored gemstones. Every tokenized gemstone is certified by recognized gemological laboratories and comes with a value appraisal from court-sworn experts with state recognition. The aim is to promote the significance of naturally colored gemstones on an international level.

The Royal Portfolio encompassed valuable gemstone necklaces, including emerald (€274,000) and ruby (€815,000) necklaces, and a rare Kashmir sapphire (€1 million), among other precious gemstones. The unique aspect of this tokenization model was the periodic revaluation of the Royal Portfolio by court experts.

Investors could acquire GEM through the Habsburg Fine Arts trading platform and the eCredits Wallet. The advantages of investing in gemstones were manifold, including their portability, high value concentration, historical reliability, and inherent aesthetic appeal.

This project, realized through the collaboration between eCredits and SimplyTokenized, a software company specializing in custom tokenization solutions, underscored the broader potential of blockchain technology in expanding the scope of tokenization across diverse asset classes.

Source: Natural Gem, Habsburg Fine Arts, Public announcement

5. Raiffeisen bank token (RBI Token)

Tokenization of e-money (stablecoin)

The tokenization platform, initially named RBI Coin, was developed by Billon during the Elevator Lab program. This system offered faster transfers, greater payment certainty, and reduced exceptions, allowing for supplementary documents and data to be included in e-money transactions for transparency and auditability. The end-to-end benefits were to be evaluated upon the pilot’s conclusion, with the aim of improving customer experience, product differentiation, and operational efficiency.

Billon and Raiffeisen Bank International (RBI) expanded their successful national currency Tokenization Platform proof-of-concept into a pilot project for select RBI clients. This pilot aimed to explore new national currency tokenization using Billon’s distributed ledger technology, previously tested during RBI’s Elevator Lab program.

The pilot was slated for completion by the end of the same year, utilizing Billon’s Digitized Distributed Cash system. This system represented a genuine tokenization of the national currency euro (€), aligning with the global trend of blockchain adoption for payment and data compliance by commercial and central banks. The aim was to expand the project to Central and Eastern European countries where RBI operates.

6. Sido Immobilien

Type: Tokenization of real-estate

The SID token represents a security token offering (STO) associated with a profit participation right in SIDO Immobilien GmbH. It works as an ERC20 token on the Ethereum blockchain.

Several ongoing construction projects included the development of multi-family houses, an expanded restaurant, office and residential buildings worth in total €15m. The financing of those real-estate projects was with equity and debt financing.

The issuance involved profit participation rights with a total value of up to EUR 20,000,000, divided into a maximum of 20,000 individual pieces, each with a nominal value of EUR 1,000. The ISIN for these rights was AT0000A2RXE4.

The participation of token holders in the issuer’s results was contingent upon several factors, including the number of tokens subscribed, the total number of tokens sold, and the profit participation factor, calculated based on the ratio of profit participation capital to the company’s equity. For instance, the sale of 20,000 tokens resulted in a distribution of 75% of the company’s profits to token holders.

At the time of the analysis, it was not possible to freely trade or sell SID tokens on a cryptocurrency exchange or a secondary market, as there were no plans for listing on such exchanges. However, P2P transfers between private participants on the Ethereum blockchain were possible.

The SID tokens offered several advantages, including asset management through blockchain technology, backing by an underlying real estate portfolio, additional rewards and actions for token holders, and being part of a Security Token Offering (STO) with an approved capital market prospectus.

The tokenization use case provided participation in the company’s profits, legal security, and annual business profits distributed directly to holders through Ethereum transactions.

Several associated risks were identified during the analysis, such as the potential for SID tokens not to be sold in sufficient quantities to cover financial needs, risks stemming from the issuer’s financial situation, the absence of a liquid market, a ten-year waiver of termination rights, and the risk of changes in the business model leading to regulatory assessments, potentially resulting in the need for concessions and additional financial expenses or, in non-compliance, a total loss of investment.

Source: Website, Whitepaper